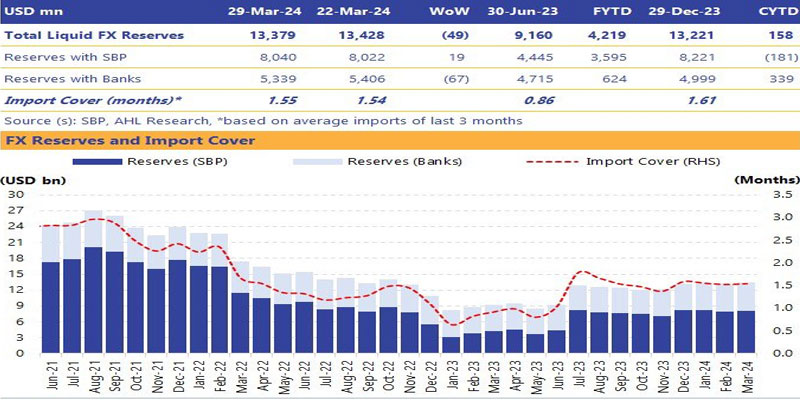

The State Bank of Pakistan announced on Thursday that the foreign currency reserves held by the central bank increased by $19 million to $8.040 billion in the week ending March 29, marking the fourth successive week of gains.

However, the country’s total forex reserves fell by $49 million to $13.379 billion. The reserves of commercial banks dropped by $67 million to $5.339 billion. Despite this decline, the SBP’s reserves are sufficient to cover imports for roughly two months.

While the central bank did not specify a reason for the ongoing increase in its foreign reserves, analysts attribute it to the rise in remittances during the holy month of Ramazan and the continuous purchase of dollars from the market by the central bank.

Additionally, international investors’ interest in government securities has increased after a four-year gap, signaling the return of hot money. This trend, coupled with the recent staff level agreement with the International Monetary Fund (IMF) to provide more financial aid, has led to a positive trajectory in Pakistan’s assets.

Analysts predict that securing the new long-term IMF deal could attract more foreign portfolio investments, supporting Pakistan’s currency and foreign exchange reserves in the near future.

However, the reserves may face pressure due to impending payments on external debt. Pakistan is preparing to fulfill its commitment to repay $1 billion on its 10-year dollar bond, scheduled to mature in mid-April.

Read Also:Pakistan Set to Make $1 Billion Bond Payment This Month

Mohammed Sohail, CEO at Topline Securities Limited, mentioned that the Pak 2024 Bond has rallied significantly in the last 18 months. Despite concerns over FX reserves falling below $3 billion in February 2023, Pakistan successfully repaid its $1 billion on the 2023 bond and bolstered its reserves, which currently stand at $8 billion (plus $5 billion in bank deposits).

Sohail noted that while the repayment of the 2024 Bond will cause a decline in reserves, the anticipated IMF tranche of $1.1 billion, expected by the end of April, is likely to restore reserves to the $8 billion mark.